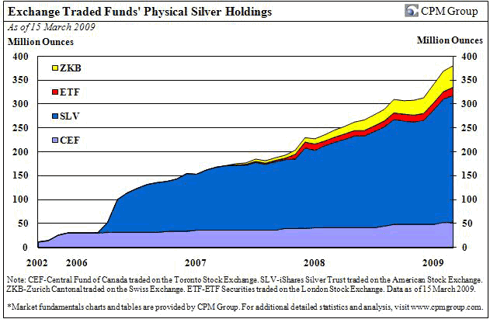

In fact, over the last several years, the ETFs for silver have taken a lot more silver deposits than withdrawals.

A look back in time - 1980. So, what we have is very similarto back when the Hunt Brothers cornered the Silver market, except this time is a tad different. Instead of just a small group of people out there tryingto protect themselves from the inflation caused by money printing and higher gas prices, there is a conglomerate of people trying to do so. What people don't know is that Silver prices during the bubble never really traded as high as they are today. For the most part, a few trades went through --- and if you were crazy, you traded this high in the futures market --- but what I am looking forward to is new inflation-adjusted highs, not just new nominal highs. My inflation adjusted all time high is $138. Looking back, this bubble has room to run.

No comments:

Post a Comment